The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. Credit Card Reviews Reviews for the top credit cards in Malaysia.

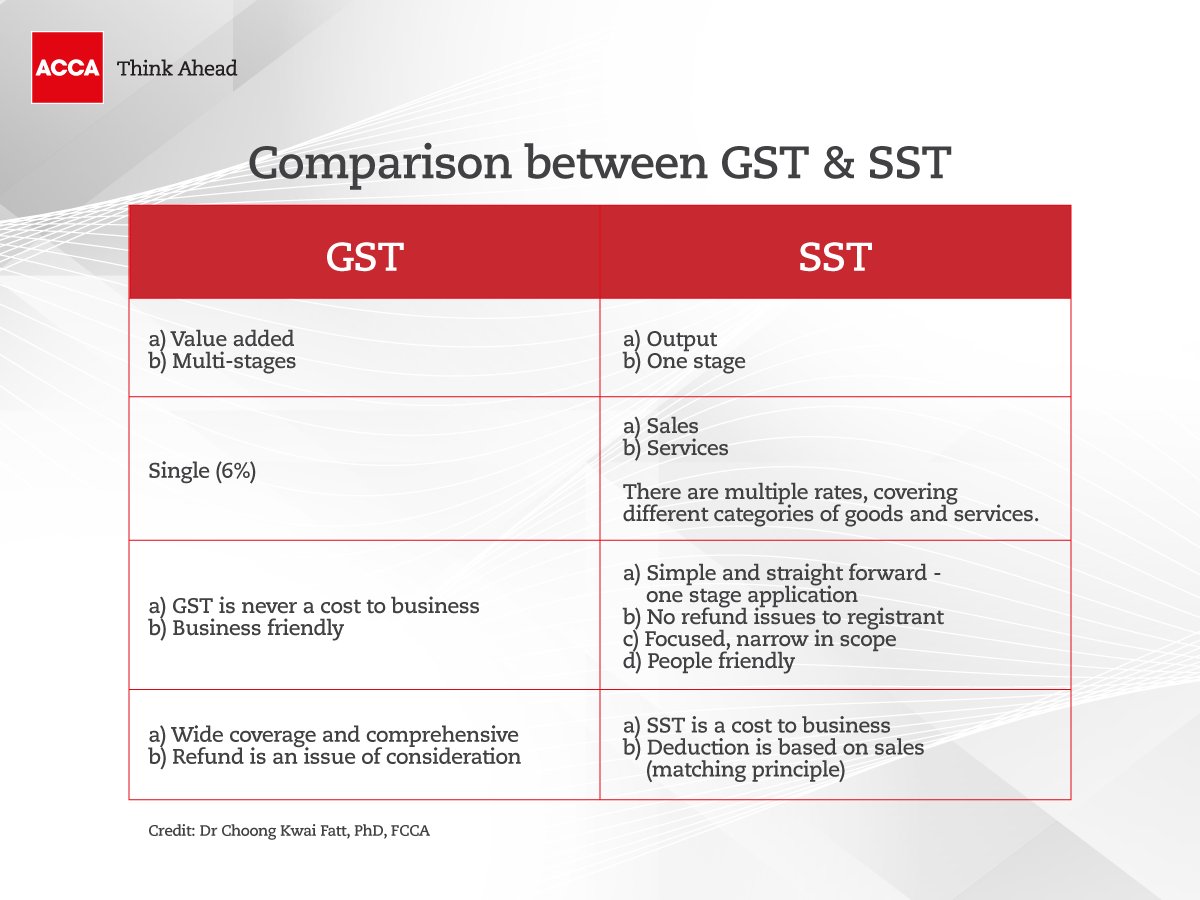

Accamalaysia No Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

The input tax claims are not disallowed under Regulations 26 and 27 of the GST General Regulations.

. Malaysia beat out countries like Australia and the United Kingdom to claim this spot. Malaysia Tourist Refund Scheme. What is GST exempt supply.

In the Accounting menu select Reports. Find and open the GST Return. For a registered taxable person if the constitution changes due to merger sale or transfer of business then the Input Tax Credit which is unused shall be transferred to the merged sold or transferred business.

GST Margin Scheme for Second Hand. For eg Bread fresh fruits and fresh milk etc. For zero-rated supplies while GST is charged at the zero rate to the end consumer businesses may claim input tax credit on the GST incurred in producing the supplies.

Xero has a Making Tax Digital MTD and non-MTD VAT return. Understand the pros and cons for each card and discover the features and benefits that could save you thousands of ringgit every year. ENTRY PERMISSION FOR EXPATRIATES WITH AN ACTIVE PASS AND APPROVED PASS APPLICATION WHO ARE ABROAD B.

Use the Zero Rated tax rate and are dated before the current GST period. Zero-Rated Goods and Services Tax GST effective 1 June 2018. Buy Raspberry Pi Zero W.

Zero-rated supplies of goods and services are subject to 0 GST. Most local sales of goods and provision of local services in Singapore are standard-rated supplies. 10K Network Hospitals Pre Post Hospitalisation Day-care Buy affordable medical insurance for senior citizens by HDFC Ergo.

A taxable supply is a supply of goods or services made in Singapore other than an exempt supply. The VAT scheme from your financial settings controls the transactions the VAT return includes and when it includes them based on VAT cash or accrual reporting requirements. 11 July 2020.

Format the SD card with SD card formatter. The Federation of Malaysian Manufacturers FMM welcomes the governments call to reintroduce the goods and services tax GST at a rate that will not burden the rakyat but still help widen the. Difference between Nil Rated Exempt Zero Rated and Non-GST supplies.

GST exempt supply is the supply of goods and services which do not attract goods and service tax also has no claim on ITC. The Pi Zero W has in-built Wi-Fi so you can use the headless Wi-Fi Setup too. Standard-rated supplies and zero-rated supplies or out-of-scope supplies which would be taxable supplies if made in Singapore.

Segala maklumat sedia ada adalah untuk rujukan sahaja. Malaysia has a well-developed infrastructure. GST List of Zero-Rated Supply Exempted Supply and Relief.

Goods And Services Tax GST Offences and Penalties in Malaysia. A taxable supply can either be a standard rated currently 7 or zero-rated supply. The input tax is directly attributable to taxable supplies ie.

If you want to include these transactions in your GST return youll need to add an adjustment. The returns use the detail from the transactions in Xero to calculate the VAT return box amounts. Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow.

Banking Terms Definitions. Section 247 under the GST Act defines the concept of exempt supply. For Malaysia Financial Reporting Standard MFRS is practiced by a company that has a holding company which needs to prepare group consolidated accounts.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. You can use the search field in the top right corner. View and file late GST claims.

After formatting open Win32 Disk Imager or Etcher locate the downloaded Raspbian image file and flash it to the SD Card. Input Tax Credit can be claimed on exportszero-rated supplies and are taxable. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Best health insurance for senior citizens above 60. On the other hand for exempted supplies businesses cannot charge GST to the end consumer and they are not eligible to claim input tax credit on the GST incurred in producing. Cost GST Total cost Deprecation charged on ITC.

What you need to know. EXIT MALAYSIA AND RETURN PERMISSION WITH AN ACTIVE PASS WHO ARE IN MALAYSIA. Malaysia has a strong educated workforce and English is widely used as a business language.

Check out the Headless Wi-Fi setup tutorial here.

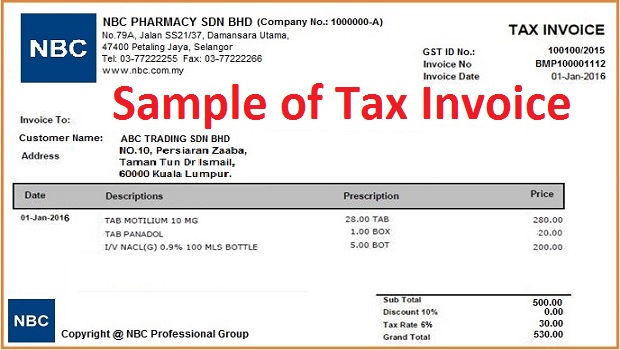

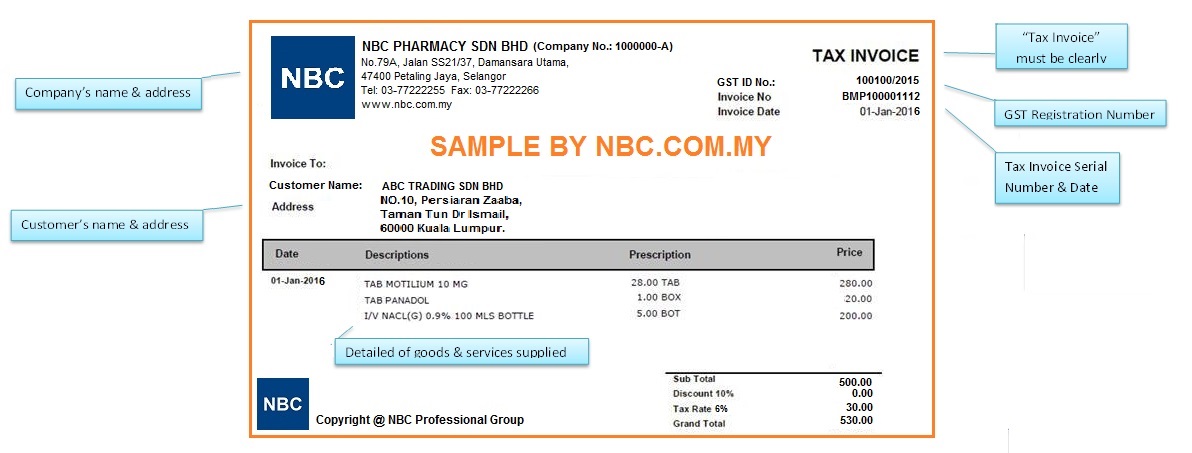

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Gst Zero Rated Mitsubishi Motors Malaysia S Vehicle Prices Reduced By Up To Rm8 7k Effective June 1 Paultan Org

Hamleys Malaysia June Is Here And We Are Starting Off With A Good News More Savings With 0 Gst Hamleys Are In Compliance With Zero Rated Gst Price Tag Adjustment Will

Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions

A Guide To Gst In Malaysia How Does It Affect Me

Ey Zero Rating Gst A Good Move To Help With Gradual Transition To Sst Regime The Edge Markets

Gst In Malaysia To Be Zero Rated Starting From 1 June 2018 Lowyat Net

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

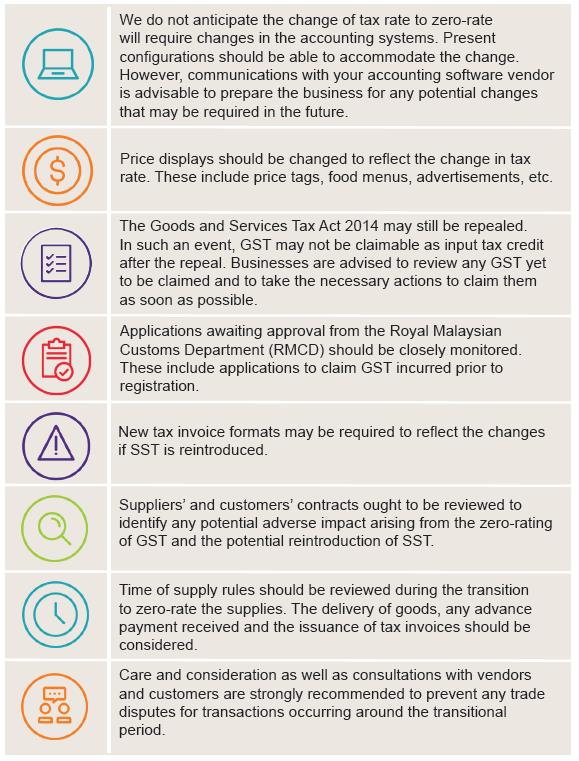

Tax Alert Grant Thornton Malaysia

What Is Tax Invoice How To Issue Tax Invoice Goods Services Tax Gst Malaysia Nbc Group

Gst In Malaysia To Be Zero Rated Starting From 1 June 2018 Lowyat Net

Gst Zero Rated Honda Absorbs 6 Gst For Civic City Cr V And Hr V Rebates Up To Rm9 5k May 18 31 Paultan Org

A Guide To Gst In Malaysia How Does It Affect Me

Notice Gst Zero Rated Enagic Malaysia Sdn Bhd Facebook